Over the past decade, Paraguay has witnessed an impressive surge in the number of registered taxpayers, signaling significant progress in the formalization of its economy. According to recent data, the number of taxpayers more than doubled from 557,944 in 2010 to 1,184,882 in 2024. This remarkable growth reflects not only modernization efforts but also effective government policies aimed at encouraging businesses and individuals to enter the formal economy.

The Key Drivers Behind Paraguay’s Growing Taxpayer Base

Several factors have contributed to the rapid growth in the number of registered taxpayers in Paraguay.

1. Digital Transformation in the Tax System

One of the primary reasons for this surge is the digitalization of tax processes. The introduction of online registration, electronic tax declarations, and simplified compliance procedures has made it easier for individuals and businesses to become part of the formal economy. By reducing bureaucratic obstacles, Paraguay’s government has created a more business-friendly environment.

2. Incentives for Formalization

The government has implemented various incentives for small and medium-sized enterprises (SMEs) to formalize their operations. In parallel, stricter measures to combat tax evasion have encouraged businesses to comply with tax regulations. This combination of incentives and enforcement has led to a steady increase in the number of registered taxpayers.

3. Economic Growth and Diversification

Paraguay’s economy has seen consistent growth, particularly in the agriculture, services, and industrial sectors. This growth has resulted in the emergence of new businesses and increased entrepreneurial activity, further expanding the country’s taxpayer base.

Breakdown of Taxpayer Growth

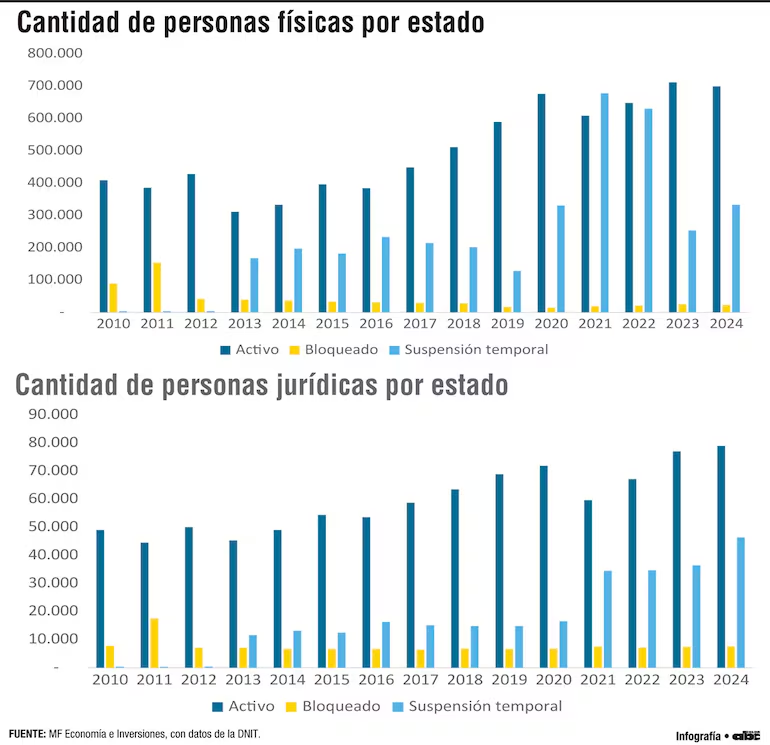

- Individual Taxpayers: The number of registered individual taxpayers increased from 500,899 in 2010 to 1,065,772 in 2024, reflecting the growing participation of citizens in the formal economy.

- Corporate Entities: Registered legal entities, such as companies and partnerships, rose from 57,045 in 2010 to 130,110 in 2024. This highlights the expansion of the business sector and the growing contribution of corporate taxes to the national economy.

Challenges on the Horizon

Despite these positive trends, Paraguay still faces significant challenges, particularly in reducing the size of its informal economy, which remains substantial. Simplifying tax compliance procedures further, providing education on the benefits of formalization, and offering financial support to struggling businesses are critical steps for the government to sustain this growth.

In addition, the number of suspended or temporarily blocked taxpayers has remained stable, suggesting that many businesses struggle with compliance over time. Providing targeted assistance to these businesses could help them remain active contributors to the economy.

The Economic Impact of a Growing Taxpayer Base

The expansion of Paraguay’s taxpayer base has several important implications for the national economy:

- Increased Tax Revenue: A larger pool of taxpayers means more funds for the government to invest in key areas such as infrastructure, education, and healthcare.

- Economic Stability: A stronger formal economy reduces reliance on external aid and helps stabilize the country’s financial system.

- Attracting Foreign Investment: An expanding formal sector makes Paraguay a more attractive destination for foreign investors, boosting job creation and innovation.

Looking Ahead: The Future of Paraguay’s Economy

Paraguay stands at a pivotal moment. With continued efforts to modernize its tax system and encourage compliance, the country can unlock even greater economic potential. Learning from the experiences of neighboring countries with successful formalization strategies, such as Uruguay and Chile, could provide valuable insights for long-term growth.

The government’s focus on digitalization, transparency, and support for SMEs will be crucial in maintaining momentum. The growth of the formal economy will not only improve public finances but also enhance the quality of life for Paraguayans by ensuring better public services and infrastructure.

Taxpayers in Paraguay: Growth Signals Economic Transformation

The increase in registered taxpayers in Paraguay shows a clear economic shift. It reflects stronger formalization and better compliance. It also indicates rising trust in fiscal institutions. More individuals and businesses are entering the legal economy. As a result, the revenue base is expanding and stabilizing.

Some challenges remain. These include administration, digital systems, and taxpayer education. However, the overall direction is positive. Continued modernization and transparency are essential. With a growing taxpayer base, Paraguay can strengthen public finances and support long-term economic growth.

Leave a Reply